Abhijit Banerjee and Esther Duflo open Poor Economics, their new treatise on development economics, by citing an experiment conducted on University of Pennsylvania students. Researchers paid students $5 to read one of two brochures about global poverty, then turned around and solicited a donation from the student. One brochure emphasized the magnitude of the problem using numbers—three million malnourished children in Malawi, eleven million in Ethiopia, etc.—while the other simply focused on the plight of one poor child, “Rokia,” whose fate could be transformed with the education and basic medical care that came with a donation of just a few dollars. The group receiving the first sales pitch donated $1.16 on average; their counterparts gave $2.83. Meanwhile, students in a third group reviewed the brochure about Rokia after being told that people are more likely to give money to an identifiable poor person; these subjects donated $1.36.

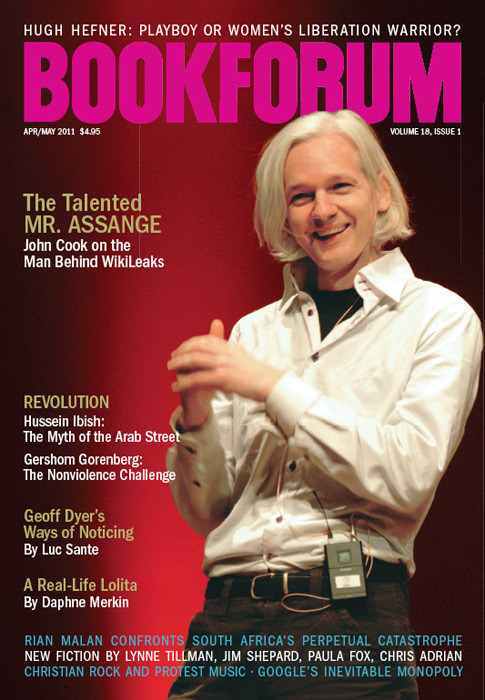

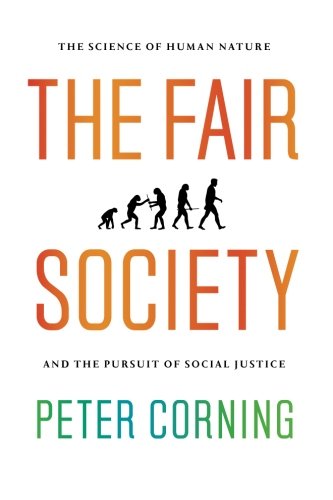

Such are the vagaries of calibrating the distribution of resources on a rigid axis of self-interest. In The Fair Society, Stanford professor Peter Corning draws on a wide range of evidence—culled from evolutionary biology, neuroscience, and anthropology—to call for a dramatic overhaul of present-day political economy, toward a more equitable system founded on humanity’s “innate sense of fairness.” It’s certainly true that science has proved that human beings are often moved to act unselfishly, that evolution has sustained the traits of altruism to promote the collective enterprise of human survival, that our neural pathways respond to a litany of hormones that produce care, love, self-sacrifice, and the like. But the Penn survey points up the limitations of Corning’s prescription: When confronted with the scientific evidence of human altruism, the subjects hunkered down and recommitted themselves to denying such blasphemous urges. This is the original sin of economics. As the Czech economist Tomáš Sedláček marvels in Economics of Good and Evil, it’s a field steeped in a spooky nostalgia for a fictitious “time when mankind knew no difference between good and evil,” an inverse Garden of Eden in which man is purged of his “conscience” and—since all the other fruits of the Tree of Knowledge are left intact—thereby freed to unambiguously pursue the natural vocation of the “rational” Homo economicus.

But where Corning and Sedláček become consumed with the immense task of correcting the cognitive sins of Homo economicus, Banerjee and Duflo—both economics professors at MIT—inadvertently make the case for Homo economicus as a useful model. If nothing else, Banerjee and Duflo’s work shows how the idealized behavior of the rational economic actor has become a self-fulfilling prophecy for the desperately poor. In swaths of the earth nearly devoid of economic hope, with upward class mobility little more than a fairy tale, all sorts of counterproductive behavior can become eminently “rational”—for example, investing in a television at the expense of food because there has to be something for the family to do while riding out a bad harvest; having nine children and spending 90 percent of family income on feeding, clothing, and educating the one with prospects of getting out of the village and taking care of his parents in old age; or simply blowing fertilizer money on moonshine. But small tweaks in the system’s incentive structures can easily make the “right” answer the “rational” one—over time, health and savings can improve, birth and mortality rates can decline, gradual progress can take hold. What Banerjee and Duflo counsel against is the irrational belief in “miracles” that so often pollutes the discourse of development economics and sets us up for failure.

The true failure of Homo economicus may be this belief in miracles. Returning to the elusive site of the original sin—putatively the free-market theorems of Wealth of Nations author Adam Smith—Sedláček and Corning confirm what students of Smith already discovered: that he took pains to distance himself from nearly every idea he is credited with inventing. Contrary to his supposed veneration of self-interest, Smith’s view of human nature was imbued with a deep regard for compassion and other “moral sentiments.” Indeed, the idea most commonly associated with Smith—the “invisible hand” that transmutes vulgar egoism and selfishness into the virtuous workings of civilization—came from the Dutch polemicist Bernard Mandeville, who coined it in “The Fable of the Bees (Private Vices, Publick Virtues),” a long semisatiric poem that possesses all the intellectual rigor of a viral Internet forward. Smith actually railed against Mandeville’s underlying philosophy—which one might call misanthroponomics—for attempting to remove the distinction between vice and virtue; he argued instead that civilization owed its existence to the common bond of “sympathy.” The expansion of this moral sentiment facilitated ever greater cooperation in ever more sophisticated endeavors—endeavors that also happened to be in each individual’s interest. In other words, it was on the basis of Smith’s humanist reverence for sympathy, and not from any idolatry of humanity’s baser urges, that he argued self-interest was not a vice.

Critics have been discovering what Corning dubs Smith’s “blasphemous thoughts” at least since the German economist August Oncken titled an essay “Das Adam Smith-Problem.” But as Sedláček points out, there’s at least a rough verbal fitness to casting Smith as the progenitor of our free-market shibboleths. After all, he notes, you couldn’t invent a more appropriate moniker for the original sinner of pseudoscientific economics than the combination of the great biblical sinner’s name with the most common everyman surname: “It is as if with a name like this, Adam Smith was predestined to a role as the father economist of the scientific era.”

In other words, Smith’s founding sin is really the handiwork of his successors, who have elevated the romantic conception that is the invisible hand into a mystical, all-powerful, and ever-virtuous force. According to one historian Sedláček quotes, the Scottish economist was in reality the “ultimate absent-minded professor,” who lived with his mother and suffered from the inveterate social awkwardness we associate with economists to this day; as the Austrian economist Joseph Schumpeter put it, “the glamours and passions of life were just literature” for him. In Smith’s character, we see an analogue of the personality type that would later produce all manner of gaping holes and glaring oversights in the architecture of the global financial system.

• • • • •

The real father of economics was, by contrast, an unbelievably exciting guy. Xenophon, born in 428 BCE, was a former general, a close friend—and biographer—of Socrates, and a onetime exile from the Athenian city-state. In contrast to the heirs of Smith, Xenophon provided a sharp outsider’s view of the organization of productive activity, the proper rewards for work, and the tendency of the powerful to elevate self-interest into a social virtue. He pioneered the concept and study of division of labor—another analytic breakthrough that economists mistakenly ascribe to Smith. Sedláček argues convincingly that Xenophon understood the logistics of a diversified economy and the intricacies of foreign trade with a much greater depth than Smith.

While this may seem surprising, it shouldn’t be. Xenophon was a habitué of a wide range of social circles—he counted slaves, foreign women, whores, oligarchs, Spartans, and barbarians among his friends (together with Socrates, of course). A reformed mercenary, Xenophon radically challenged notions of economics as a zero-sum game by encouraging Athenians to stop thinking of war as the only way to stimulate the city-state’s economy; he proposed instead that they could arrive at a much more sustainable form of growth by offering citizenship privileges to resident “aliens” so as to instill goodwill toward and loyalty to the state.

It’s curious that the founder of Western economics should now command so little attention—even Sedláček discounts Xenophon as a “mediocre philosopher.” That is presumably why Sedláček barely mentions Xenophon’s best-known Socratic dialogue, the Oeconomicus—but a quick review of the work will underline the way Xenophon pinpointed the discipline’s original sin early on. It’s true, however, that the dialogue proper can be rough going. It’s a deceptively tedious months-long exchange between Socrates and a “perfect gentleman”—a good-natured, rich overlord of an industrial farm—named Ischomachus, who loves to talk about himself. They discuss Ischomachus’s wife, her grooming habits, his house and servant/slave hierarchy, the secrets to effective “training” of one’s wife, servants, and slaves, how to farm, how to make money, and other mundane matters. (The word oeconomicus, or “economics,” comes from the root oikos-, or “household,” and meant something like what we today call home economics.) It’s hard to read the Oeconomicus and not imagine its lead theorist of rational economic behavior writing a column for Forbes or handing out advice to nations in the developing world.

Indeed, his oblivious and tedious self-absorption renders Ischomachos inadvertently fascinating: Here, it seems, is the principle of self-interest in human form. As the dialogue unspools, it becomes clear that he has never even contemplated the possibility of a human relationship without an at least underlying economic agenda. In one stirring episode, he shares an anecdote about coming home dismayed to find his wife wearing high-heeled boots, face powder, and rouge. Comically, he explains his opposition to her new look by entreating her to see the issue from his perspective: What if he had attempted to deceive her about his “worth” by parading around in purple robes and gilt wooden necklaces while waving counterfeit money? “Hush, don’t you become like that!” she replies. “If you did, I could never love you from my soul.” Ischomachus relates this story to demonstrate a successful technique for “training” his wife to be the obedient, effective, and exacting domestic partner she is— she never wore makeup again after that. And there’s more: By instructing her to train others in the same way—when you teach a slave to spin wool, he explains, “she is worth twice as much to you”—he has maximized his wife’s domestic utility. Socrates asks Ischomachus whether his wife might have simply been predisposed to being a good wife; Ischomachus waves away the suggestion—she was only fifteen years old when they married, so what could she possibly have known? But, ever unselfconscious, he proceeds to undermine this line of reasoning by recounting how his wife dismissed his admonition to take “care” of her personal possessions: He tells Socrates that “just as it seems natural for a sensible woman to be concerned for her offspring rather than to neglect them,” so it came quite naturally for her to look after “those possessions that delight her.”

Finally, Socrates decides he needs to try his hand at the “art” responsible for his new friend’s great fortune, agriculture. Ischomachus encourages him, pointing out that farming is civilization’s most virtuous industry, so long as one doesn’t complicate the process by seeking enlightenment about the nature of the earth and the seasons; the right way to farm is simply to imitate a neighboring farmer and work very, very hard. Ischomachus explains that he learned his own diligence—or his penchant for “teaching” diligence, at any rate—from his father, who made the family fortune by acquiring run-down plots of land, improving their yield, and flipping them for considerable profit. He was known, according to his doting son, to be the “Athenian most in love with farming.” (Here again, the modern reader can’t help but ponder the disjunction between the outsize moral claims made for the father and his actual conduct as a predatory manipulator of market relations; his latter-day cognate would seem to be Donald Trump, or any number of traders who kept the once-humming AIG in collateralized debt obligations.)

The ostensible purpose of the Ischomachus stories is self-help; Socrates’s disciple desires to become a “perfect gentleman” in the mold of the landowner, and so Socrates is just passing on what he’s been told. But as a dialogue between Socrates and the disciple about the differing meanings of the word value makes clear, the Oeconomicus’s own pedagogical method is anything but straightforward—the dialogists discuss, for instance, the worth of a flute to a person who knows how to play it versus its value to one who doesn’t, and the amount of hallucinogenic nightshade or time with a prostitute for which a man who has been “enslaved by his appetites” might barter the same flute. Everything is relative, meaning is fairly meaningless, delusion drives the fulfillment of human appetites, and Ischomachus can hold forth on matters like “freedom,” “equality,” and “justice”—and, most preposterously, “love”—without anyone ever pointing out his ignorance of such concepts.

As Leo Strauss first noted in his influential reading of the Oeconomicus, Socrates proves that Ischomachus has confused his father’s love of money for love of farming—and by extension, he has failed to distinguish the sentiments one feels toward a lump of silver and toward one’s wife. This was not only depressing; it also had ominous implications for the future of society. Xenophon would later make that very point in his treatise on macroeconomics, On Revenues, observing that “no one ever yet possessed so much silver as to want no more; if a man finds himself with a huge amount of it, he takes as much pleasure in burying the surplus as in using it”—all the while telling himself that this pathological pursuit was born of “love.” Xenophon exhorted Athenians to stanch this epidemic of wealth addiction by undertaking an ambitious Keynesian public-works program, exhuming their excess silver for the purpose of building roads, sewers, ships, and proper housing for the immigrants who might be incentivized to rebuild the empire.

In his matter-of-fact explanation of the management skills for which he credits his vast (inherited) wealth, Ischomachus brings to mind the billionaire Charles Koch, who has dedicated an entire institute to the study of the “market-based management” theories he recently detailed in a book called The Science of Success, even though this commercial titan’s career has largely disproved the effective power of science, free markets, and other mantras of management theory. Koch, too, inherited the foundation of his fortune—an oil company that generated $500 million in annual revenue at the time his father bequeathed him the corner office. (Though it’s true that Koch’s pluck—together with rampant speculation in the oil-commodities market—has sent that estimable legacy skyward; his net worth is estimated at $21.5 billion.)

Xenophon saw menacing implications in the hoarding of all that buried silver, but like Socrates he was powerless to do anything but chronicle his worries. Socrates concludes his dialogue with Ischomachos by awarding him his version of an honorary degree. Strauss interprets this gesture as a foreshadowing of Xenophon’s later work Hiero, or The Tyrant, in which a morally repugnant and paranoid dictator is humored by the obsequious poet (and notorious miser) Simonides. The poet counsels the tyrant on his depression, in the sort of dishonest, transactional—but nevertheless illuminating—interaction that characterized the relationships between wealthy Athenians and many of the Sophists. As Corning reminds us, the Sophists advanced arguments condemning altruism as “unnatural” and dismissing democracy on moral grounds for “allowing the poor to exploit the rich”—an enduring fear that lies at the heart of the entire Republican agenda, in which the “left” must be defunded at all costs on the basis that democracy, in granting beneficiaries of social-welfare programs the right to vote, has sown the seeds of its own insolvency and destruction, leaving the wealthy to foot the bill.

• • • • •

Poor Economics makes the case that society would benefit if the rich would allow themselves to be thus “exploited”—and so far Banerjee and Duflo’s research shows that, in defiance of free-market dictates, such an appeal to public-minded sympathy is far from fanciful. The two researchers run a lab at MIT funded by billionaires who share a curiously nonlibertarian outlook and staffed by economists who traverse the most impoverished corners of the world. The research team conducts laborious randomized trials to figure out how to incentivize the poor to wear condoms, take their tuberculosis meds, get their kids to school, and vaccinate their babies, among other actions that are both personally and socially beneficial.

The lab’s efforts have breathed new life into the elaborate (if so far ineffective) existing network of philanthropic aid organizations. More profoundly, they have laid bare the inanity of the argument—most famously advanced by the libertarian Nobelist Milton Friedman—that the profit motive is inextricable from the solving of problems. Plutocrats who can actually boast that they’ve profited by problem solving seem paradoxically more likely to believe in the randomness of fortune; on the subject of the current state of wealth distribution, Corning quotes Microsoft founder–cum–global philanthropist Bill Gates: “It’s a mistake.”

Is it? Duflo and Banerjee trace many of the struggles of the lower third world to poorly designed infrastructure—the handiwork of corrupt colonial leaders who proceeded along a rigid developmental path of exploitation and extraction, conquering by dividing. Poverty traps and economic stagnation are ultimately, according to Duflo and Banerjee, the result of explicitly engineered inequality.

Indeed, in its modern incarnation, economics has mostly served to justify and explain away inequality and the deliberateness of its imposition. It’s a story told, fittingly enough, in numbers. Over the past three decades or so, the presence of trained economists in a region has had a sharply inverse correlation with sustained economic growth. In the early years of Communism’s collapse, for instance, Russia was occupied by a battalion of Harvard economists on contract with the US government, producing in comparatively short order a halving of the Russian gross domestic product—together with a federal lawsuit charging the university with defrauding the Russian government. The Chinese economy, by contrast, which employed virtually no Western economists in the design of its reform policies, has expanded ninefold since 1990. (Over that same period, China has become decisively less equal—but nothing like Russia, which squandered its own potential “equality advantage” as a post-Communist economy.)

The story of post-Communist Russia and the brutal rise of the oligarchs shows the enduring resonance of Mandeville’s simplistic misanthroponomics. In America, meanwhile, wealth continues to be mistaken for virtue, since many of its best-known mascots, such as Gates and Steve Jobs, double as poster boys for technological progress. The attainment of so many vast fortunes by individuals who didn’t ruthlessly exploit countless humans in the process is a relatively new phenomenon in human history. It helps explain the continued stranglehold of the invisible hand on public perceptions of the economy, and not just in the United States; in Sedláček’s native Czech Republic, President Vaclav Klaus, a regular contributor to Cato Institute publications and a favorite on the right-wing think-tank circuit, is seen as the “hidden adversary” of Economics of Good and Evil.

For his part, Xenophon drew a distinction between “economics” and “chremastics,” i.e., the pursuit of wealth for wealth’s sake. The ancient Greeks understood such rudderless accumulation as a sick and unnatural endeavor. By contrast, rarely do today’s apologists for libertarian capitalism pause to note that the success of a Gates or a Jobs relies on a large class of consumers with relatively equal purchasing power. Today’s pseudoscientific economists have no patience for reckoning with the morality of wealth. That omission leaves the rest of us to hope our oligarchs and robber barons might eventually stumble on some of the bitterer fruits of knowledge. They would do well to note that Ischomachos went on to lose one of his most prized posessions—the wife he bragged about in the Oeconomicus. Accounts vary, but it’s thought she absconded with her son-in-law—and the bereft daughter, in turn, took her own life. Ischomachus died wealthy and miserable.

Maureen Tkacik is a Washington, DC–based writer who cofounded the website Jezebel.